Financial Clarity Through Smart Budget Strategies

Learning to manage money during uncertain times isn't about cutting everything you enjoy. It's about making choices that align with what actually matters to you.

Our autumn 2025 program focuses on practical budget techniques developed through working with hundreds of individuals and families across Taiwan. You'll learn methods that adapt to your life, not the other way around.

People Who've Been There

Our instructors have navigated their own financial challenges. They understand the stress of making difficult budget decisions because they've lived it themselves.

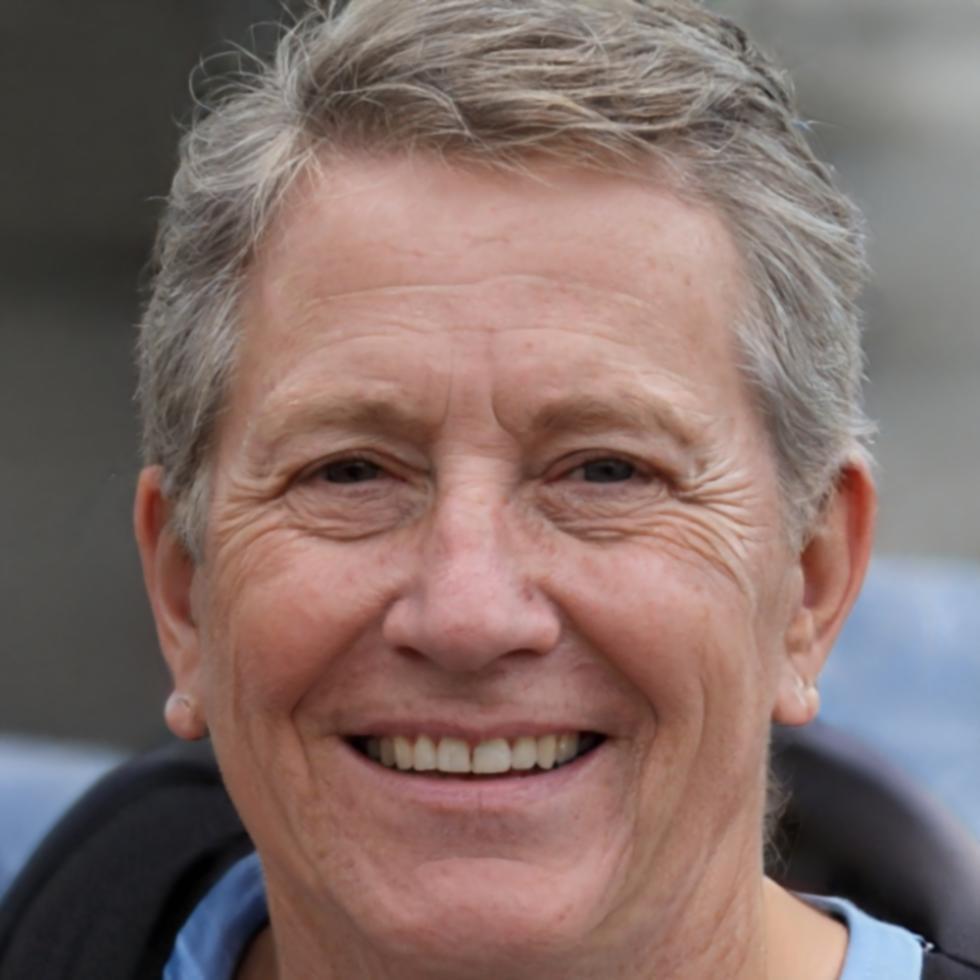

Rowan Thistlewood

Budget Systems SpecialistAfter restructuring his own family finances in 2021, Rowan developed tracking methods that work for people who hate spreadsheets. His background in behavioral economics shows in every lesson.

Lennart Vinterberg

Household Finance CoachLennart spent years analyzing spending patterns in small business environments. He brings that analytical mindset to personal finance without making it feel like a corporate audit.

Casimir Wolski

Financial Resilience AdvisorHaving rebuilt his finances after a career change in 2020, Casimir understands how to adjust budgets when circumstances shift unexpectedly. His practical approach focuses on sustainable habits.

Elspeth Drummond

Spending Psychology ExpertElspeth combines psychological insights with financial planning. She helps participants understand why they spend the way they do, which turns out to be half the battle in budget management.

What You'll Actually Work On

Building Your Budget Framework

Forget the one-size-fits-all advice. We start by mapping your actual spending patterns, then create a system that reflects your priorities. Some people need detailed tracking. Others need broad categories and flexibility.

Making Strategic Cuts

Not all expenses are created equal. You'll learn to identify which cuts save meaningful money versus which just make you miserable. We look at subscription audits, negotiation techniques for bills, and ways to reduce costs without feeling deprived.

Handling Financial Curveballs

Life doesn't follow a budget spreadsheet. The program includes scenarios for managing unexpected expenses, income changes, and those months where everything seems to go wrong at once.